The Future of IPMI:

Insights from McGrigor Group and VUMI®

VUMI® recently spoke with James McGrigor, CEO of McGrigor Group, one of the world’s most respected authorities on the International Private Medical Insurance (IPMI) market. Since 2008, McGrigor Group’s Global Surveys have been a trusted resource for insurers, service providers, brokers and TPAs, offering unparalleled depth on market trends. Their latest edition — the most comprehensive ever — spans 850 pages and 550 charts, covering 25 of the world’s largest markets. James was joined in the conversation by consultant Dominic Chu, who has worked extensively with the group on global research and analysis.

Together, they shared their perspective on the rapid changes shaping the IPMI industry. They had much to say on how VUMI® has positioned itself as a leader in Latin America and beyond.

Technology Driving Change

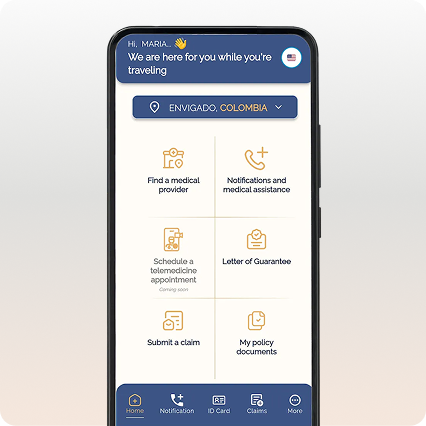

According to McGrigor, the pace of digital transformation is reshaping the way clients and insurers interact. From digital membership cards that allow direct provider payment, to app-based claims submission and the surge in telemedicine, insurers are reinventing the customer experience.

While many might assume these advancements raise costs, McGrigor agreed for the immediate term but predicted the opposite over time: “Insurers gain better control, reduce administrative overhead, and importantly, see higher client loyalty. It’s a long-term win-win.”

AI: From Efficiency to Full Value Chain Integration

Artificial intelligence is already playing a role in claims automation, fraud detection, underwriting and customer service. Looking five years ahead, McGrigor sees AI permeating the entire IPMI value chain:

❂ Members will receive real-time preventive advice based on wearable data.

❂ Providers will be selected based on optimized outcomes and price transparency.

❂ TPAs will evolve into fully AI-driven operations, managing everything from incident reporting to claims settlement and post-care support.

Still, he stressed that the “human touch” remains vital: “Winning new business and renewals, especially in markets like Latin America, will always require strong broker relationships.”

Personalization: The New Standard

VUMI’s recent launch of MyVIP Care, which empowers insureds to design plans around their needs and budgets, reflects a wider industry shift. Customization is no longer optional – it is the expectation.

While tailored products may tighten margins for insurers, McGrigor sees the upside: “Personalization drives retention, loyalty and better health outcomes. Those insurers who don’t adapt will not succeed.”

Global Mobility and Emerging Segments

Though the hype around “digital nomads” may be overstated — McGrigor estimates that number is closer to 4 million globally, rather than the 40 million often cited —global mobility is fueling demand in key segments. Growth is particularly strong among:

❂ Young professionals on short-term international assignments

❂ Retirees and students

❂ Small and medium enterprises (SMEs), often under 80 lives

❂ Large corporate accounts in the Middle East and Asia

McGrigor also states that in Latin America, shorter-term plans, regionalized benefits and flexible coverage structures are increasingly attractive.

VUMI®s Leadership in

Latin America

Asked about VUMI’s success in the region, McGrigor was unequivocal:

❂ Competitive pricing has consistently set the company apart.

❂ An aggressive and agile sales force has captured market share.

❂ VUMI® has moved faster than competitors in cost containment.

He noted that under David Rendall’s leadership, the company seized opportunities quickly, such as during the GBG episode, and has achieved double-digit growth annually. Having consolidated its #1 position in Latin America, VUMI® has expanded successfully into Canada, Asia, Africa, the Middle East, and now Europe.

“Compared to similar-sized insurers, VUMI® has moved very fast and confidently,” McGrigor observed.

The Power of Integration

VUMI’s membership in a vertically integrated enterprise group — including NHSI (National Healthcare Solutions, Inc.) and its U.S.-based preferred network, as well as its PBM VerusRx. This sets it apart from traditional insurers. This model, McGrigor argued, strengthens VUMI’s ability to implement effective cost containment while maintaining strong provider relationships.

Regulatory Headwinds

Government regulation is one of the most significant challenges facing IPMI providers. In Latin America, offshore gross written premiums have fallen from two-thirds of the market in 2019 to just one-third in 2024. Coupled with GDPR requirements in Europe and tightening fraud monitoring, margins are being pressured.

McGrigor suggested a selective approach: “Companies must decide their strategy carefully – some might be able to focus on markets that remain offshore-friendly, although there are fewer of these than in the past – and in some cases, strategically base operations in jurisdictions where costs are low, and where the regulation is accepted as good but not excessive.”

Brokers and the Human Factor

Despite advances in automation, McGrigor emphasized the enduring importance of brokers and agents. In Latin America, 75% of policies are individual, with customers valuing human guidance. Even as claims become more automated, agents will remain essential — not only in sales but in helping clients navigate digital tools, wearables and new benefit models.

Growth Markets and Inflation Pressures

Looking ahead, McGrigor sees strong growth potential in Argentina, Chile, Central America, Saudi Arabia, West Africa and the Mediterranean. At the same time, he warned of the threat posed by double-digit medical inflation in Latin America, which is forcing even high-net-worth individuals to reconsider coverage. Solutions will involve prevention, flexible pricing systems, stricter provider networks and incentives for regional treatment.

A Future Built on Agility

As the conversation closed, McGrigor stressed that the winners in IPMI will be those who combine technological agility, strong broker networks and a relentless focus on customer outcomes.

“From what I’ve seen,” he said, “VUMI® is very strong at its broker management and its ability to adapt to change. These are the factors for long term success.”